How Many Years Do You Live in a House Before Its Worth Selling Again

Selling too apace can be costly

Very few houses turn into "forever" homes. Fact is, most people who buy a dwelling house move on to another residence after a certain time.

Per the National Clan of Realtors, 10 years is the average length of time a homeowner remains in a house. But that begs a question: What the minimum corporeality of fourth dimension yous should stay put before moving? How long before y'all should consider selling a domicile?

The answer will depend on several factors. A new task opportunity, growing family situation, sudden divorce or another major life event can exist a compelling reason to sell your abode and move elsewhere. Merely selling also rapidly later on buying can be costly. If not timed right, you lot could wind upwards losing money overall instead of making a profit on the sale.

It could be wise to agree that business firm a flake longer.

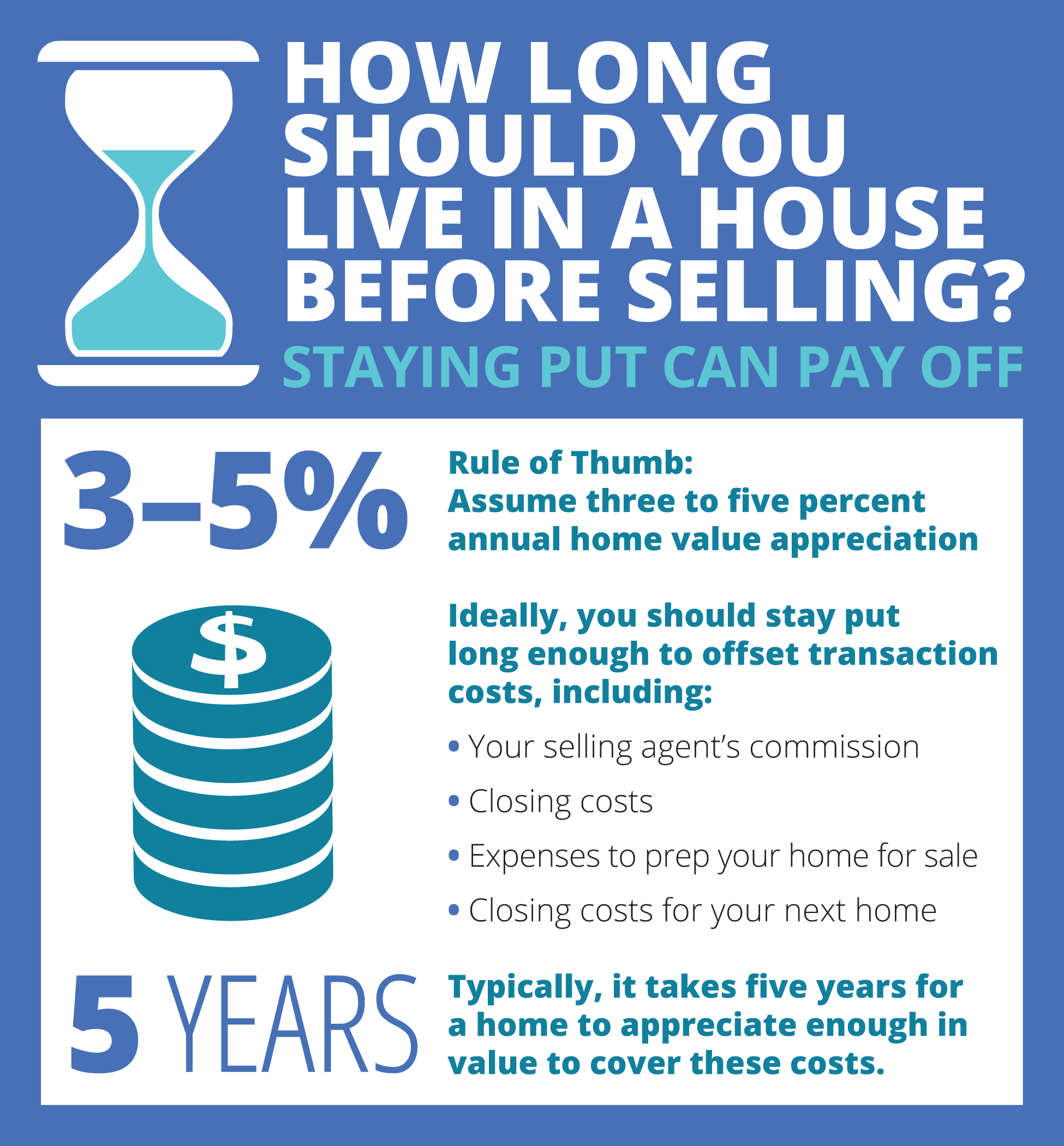

Staying put tin can pay off

Inquire real estate attorney Mel Black how long before you should motility and he'll tell you lot that "buying a home is non a determination to exist taken lightly. You should take a number of factors into consideration before purchasing. This includes how long you plan to alive in the dwelling."

Realtor and real estate chaser Bruce Ailion agrees.

"Equally a general rule, a buyer should plan on staying five or more years in a abode," says Ailion. "A large reason for this is the transaction costs of selling your home and ownership another are loftier."

By transaction costs, Ailion means:

- Your selling agent's commission (typically 6 percent of the home's sale price)

- Closing costs (which can range betwixt 2 and 6 per centum of your dwelling house's value)

- Expenses to prep your home for sale and move

- Closing costs involved with buying your side by side home (commonly iii to 6 percent of that home'southward toll).

"You tin can wait transaction costs to add up to 10 to xv percent of your abode's sale price," says Ailion. "Assuming a three to v percent annual home value appreciation over the long term, it is going to have time to accept the increased value of the property to cover the transaction costs."

Ailion says these transaction costs should come up from the proceeds of the sale and are not otherwise recoverable.

"If the proceeds of sale do non cover all these costs, you lot must pay the remainder out of pocket," Ailion warns.

The bottom line on how long before yous should sell? "Homeownership should be viewed as a long-term investment," adds Ailion.

Equity considerations

Truth is, yous'll pay these transaction costs regardless of when you lot motility. Simply at that place'southward a benefit to waiting to sell for at least three to five years subsequently ownership: accrued equity.

Your disinterestedness is the difference between the abode'southward market value and what you owe your mortgage lender.

Simply put, your equity is the portion of your home yous own outright. Information technology's the divergence betwixt the home's market value and what you owe your mortgage lender. The portion you paid as a down payment counts toward your equity.

You also build equity when your abode appreciates in value due to a potent local existent estate marketplace and home improvements you lot brand. You further build disinterestedness every bit y'all pay downward the principal on your mortgage.

Problem is, during the first several years of your mortgage payments, you pay more toward the involvement owed than the principal. Sell likewise soon after getting a mortgage loan and it'due south possible that y'all'll pay more than to the lender than you'll earn on the home's sale.

For case:

- Original purchase price: $260,000

- Mortgage owed: $250,000

- Dwelling house value: $270,000

- Closing costs, real estate commissions, house prep: $27,000 (x% of current home value)

- Sale proceeds: $243,000

- Corporeality owed out-of-pocket to lender: $7,000

Look it out to avoid taxes

How long earlier you should sell? The revenue enhancement human being will tell you lot to stay put for at to the lowest degree a couple years. That's because you'll pay capital gains taxes (at a rate that depends on your income) if you sell your domicile less than two years subsequently buying.

To avoid capital gains tax, the dwelling must be your primary residence for ii of the v years prior to the sale.

To avoid this, the home must be your primary residence that you live in for a minimum of ii of the five years prior to the auction. Meet this benchmark and you can exclude $250,000 ($500,000 for married couples) of your sale'southward profit from capital gains tax.

Local market conditions

Regardless of when y'all're eager to sell, the condition of your local market can make a big difference, too. If yous want to sell at present and your market currently favors buyers, you'll probably non get as high a sales price as you'd like.

Waiting for a stronger seller's market would be wise. But it may take a long time for the marketplace to swing in your favor. Of course, if you demand to buy a unlike dwelling house at the same time yous sell one, the lower cost pay on the new home could offset your habitation auction loss.

"There are better times than others to make a real estate transaction. Smart consumers fourth dimension their existent estate transactions to market atmospheric condition," notes Ailion. "You should purchase when the market is soft and yous tin make a good purchase. You lot should sell when the market is stiff."

For all these reasons, Black says a house buy should ideally mean a long-term commitment to a detail geographic area.

"Have plans to head out of town for a new job in a year? Don't know if you desire to stay put if yous happen to lose your chore? Then buying a home probably isn't for you," says Black. "Homeownership needs to make sense for where you are right now and in the near- to long-term future."

When waiting isn't an option

For some, the answer to how long earlier you should sell is immediately. Sometimes it tin can't be helped: You lot simply take to motion before long due to an of import life issue, even if it means you could lose money on the sale.

"In this instance, it'south a proficient idea to engage a top Realtor with a strong marketing program in lodge to become top value. This professional person can provide tips to prepare your home for maximum value," suggests Ailion.

But here's a tip: "If you are going to lose money or are facing a hardship, ask your agent for a discount on their commission. Top Realtors are not without a centre," Ailion notes. "I've reduced my commission to help clients in their time of need."

Get pre-approved for your side by side home purchase

If yous plan to sell your dwelling house, make sure yous tin buy some other if that's your plan.

Get pre-canonical at the link below so you can confidently shop for your side by side home.

The information independent on The Mortgage Reports website is for informational purposes simply and is not an advertising for products offered past Full Chalice. The views and opinions expressed herein are those of the author and practise not reflect the policy or position of Full Chalice, its officers, parent, or affiliates.

rooseveltgoist1945.blogspot.com

Source: https://themortgagereports.com/49194/how-long-should-you-live-in-a-house-before-selling

0 Response to "How Many Years Do You Live in a House Before Its Worth Selling Again"

Postar um comentário